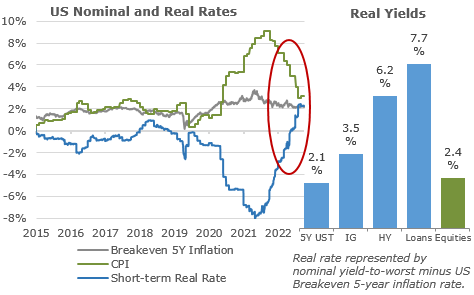

Following further slowdown in inflation expectations, real rates have surged in the last three months and are now exceeding 2%. The positive long- and short-term real rates benefit fixed income investors across entire spectrum of credit market sectors. Due to relatively tight investment grade credit spreads, real yields of 3.5% on IG corporates only slightly exceed 5-year US treasury real rates of 2.1%.

On the other hand, at 6.2% and 7.7% respectively, the real yields on high yield bonds and syndicated loans comfortably exceed real yield on equities, even under optimistic earnings growth assumptions. In addition to relatively wide credit spreads, syndicated loans benefit from high short-term rates on an inverted nominal rate curve. These short-term rates serve as benchmarks in loans’ floating-rate coupons. High real rates, however, also mean rising refinancing risks for borrowers and require high quality active credit management.

Read more in our Alternative Credit Letter