CREDIT

Key takeways

- Credit markets have grown rapidly in the last decade and are now well established across all major market participants.

- Fixed-income investors can explore compelling investments for any risk profile in a wide credit universe.

- Professional investors, such as insurance companies or pension funds, are turning their focus to credit investments to meet their need for return generation and steady income streams and meet their liability requirements.

Credit Investments - More than just Yield

One of the key tasks of investment managers is to identify attractive sources of returns for their clients. This work has become even more challenging in today’s volatile environment. Identifying appealing and sustainable investment opportunities is key.

Moreover, professional investors, such as insurance companies, pension funds and independent wealth advisors, turn the focus to credit investments not only to explore attractive risk-adjusted investment opportunities but also to meet their liability requirements.

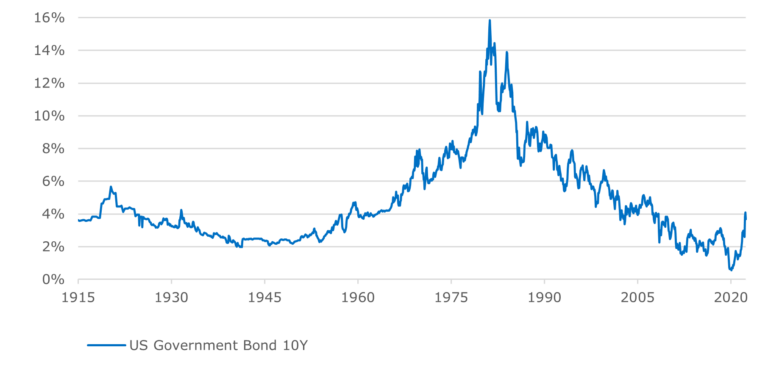

The lowest interest rates in 100 years asked for alternative income sources. The recent paradigm shift in interest rates calls for active selection and risk management to adjust the portfolio to the prevailing market environment.

Source: Tradingeconomics.com, U.S. Department of the treasury; Alpinum Investment Management

Short maturity bonds

The paradigm shift in interest rates forces professional investors to engage in repositioning their fixed income portfolios for these challenging market scenarios.

Investors with a limited risk budget seeking a higher yield than cash investments find a variety of income sources and investment solutions in the credit market. For example, a portfolio of well-selected short-term bonds can provide the required return profile as it keeps both the interest rate and corporate default risk at a minimum.

Tapping the depth and breadth of the Credit Universe

Investors seeking an attractive cash yield or a compelling return find a broad range of income sources and investment solutions in the wide universe of the credit market. Depending on the investors’ risk appetite and liquidity considerations, the return goal can be increased by implementing a more active investment approach, taking advantage of niche markets, diving into more complex credit asset classes, tapping the structured credit market or accepting a less liquid investment format to earn an additional illiquidity premium.

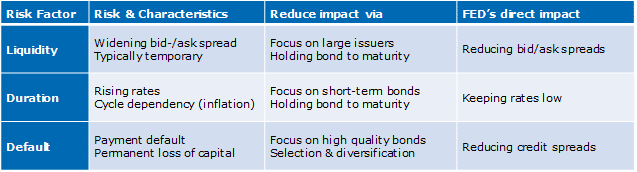

Taking up the risk perspective, a large range of parameters need to be taken into consideration. Among many others, we list below a set of main risk factors for the determination of a bond price in a given reference currency:

Source: Alpinum Investment Management

Sign up

Stay up to date and subscribe to our Alternative Credit Letter.